In short: Yes.

Just to make sure, you wish you'd put in $280,000, since you're married filing jointly and have two accounts in which to put each $140,000 gift.

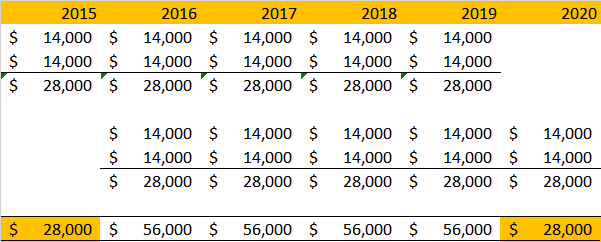

I'm assuming by "last year" you mean tax year 2015. So if you contributed $70,000 to each child, that would be $28,000 spread out over five years, so you've got another $28,000 this year and each year through 2019. If you contribute an additional $140,000 split between the two accounts, you can claim a second 5-years of forward-funding, with an additional $28,000 allocated towards your gift cap for each beneficiary.

There is nothing you can do about the missed 2015 contribution, but note that you will be eligible to make an additional contribution of $28,000 ($14,000 into each of the two accounts) in tax year 2020, assuming the gift tax limit has not been changed by that time.

Now, all the above said, I'll point you to the disclosure below my signature!

Good luck,

Brian Boswell

VP, Research & Development

This information does not constitute tax advice and is provided for informational purposes only. Please consult your tax advisor, financial advisor, local taxing authority, and/or plan provider or sponsor for more information.